irvine ca income tax rate

775 The total of all sales taxes for an area including state county and local taxes Income Taxes. The latest sales tax rate for Irvine CA.

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

775 The total of all sales taxes for an area including state county and local taxes Income Taxes.

. What is the sales tax rate in Irvine California. This rate includes any state county city and local sales taxes. A combined city and county sales tax rate of 175 on top of Californias 6 base makes Irvine one of the more expensive cities to shop in with 1117.

If taxable income is over. The US average is. Heres how taxes affect the average cost of living in Irvine CA.

Tax Rates for Irvine CA. Did South Dakota v. The average cumulative sales tax rate in Irvine California is 775.

- The Median household income of a Irvine zip 92618. A combined city and county sales tax rate of 175 on top of Californias 6 base makes East Irvine Irvine one of the more expensive cities to shop in with 1117 out of 1782 cities having a sales tax rate this low or lower. The US average is 28555 a year.

The US average is 46. East Irvine Irvine 7750. The US average is 28555 a year.

Whether you come in to your local Irvine HR Block office to work with your tax pro or drop off your documents and go your well-being is our. - Tax Rates can have a big impact when Comparing Cost of Living. - The Income Tax Rate for Irvine is 93.

074 of home value. The California sales tax rate is currently. This is the total of state county and city sales tax rates.

A combined city and county sales tax rate of 175 on top of Californias 6 base makes University Park Irvine one of the more expensive cities to shop in with 1117 out of. The County sales tax rate is. The median property tax in California is 283900 per year for a home worth the median value of 38420000.

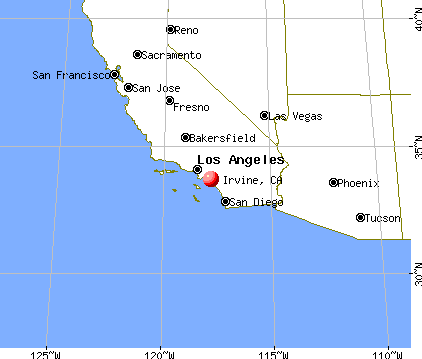

Irvine is located within Orange County CaliforniaWithin Irvine there are around 13 zip codes with the most populous zip code being 92620The sales tax rate does not vary based on zip code. - The Income Tax Rate for Irvine zip 92618 is 93. 2020 rates included for use while preparing your income tax deduction.

This includes the rates on the state county city and special levels. Counties in California collect an average of 074 of a propertys assesed fair market value as property tax per year. View all 42 Locations.

Income and Salaries for Irvine - The average income of a Irvine resident is 43456 a year. But unless youre getting paid under the table your actual take-home pay. While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725.

The California sales tax rate is currently. Sales Tax in Irvine CA. The US average is 46.

Income and Salaries for Irvine zip 92618 - The average income of a Irvine zip 92618 resident is 46989 a year. 10 rows Sales Tax. California income tax rate.

At this point it may make sense to get help from. Irvine Tax jurisdiction breakdown for 2022. Income and Salaries for Irvine zip 92618 - The average income of a Irvine zip 92618 resident is 46989 a year.

While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725. 10 rows Sales Tax. California Department of Tax and Fee Administration Cities Counties and Tax Rates.

The minimum combined 2022 sales tax rate for Irvine California is. The state of Californias income tax rate is 1 to 123 the highest in the US. - The Median household income of a Irvine resident is 91999 a year.

Your job probably pays you either an hourly wage or an annual salary. 30 rows - The Income Tax Rate for Irvine zip 92618 is 93. This is the total of state county and city sales tax rates.

Tax amount varies by county. Wayfair Inc affect California. These figures are for the 2022 tax year.

4330 Barranca Pkwy Ste 150a. The Irvine sales tax rate is. - Tax Rates can have a big impact when Comparing Cost of Living.

Realistic real estate value appreciation will not increase your yearly bill sufficiently to justify a protest. California City County Sales Use Tax Rates effective April 1 2022. How Your California Paycheck Works.

930 The total of all income taxes for an area including state county and local taxes. Census Bureau Number of cities that have local income taxes. Carefully calculate your actual property tax including any exemptions that you are allowed to have.

Median household income in California.

Understanding California S Property Taxes

Irvine California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Orange County Ca Property Tax Calculator Smartasset

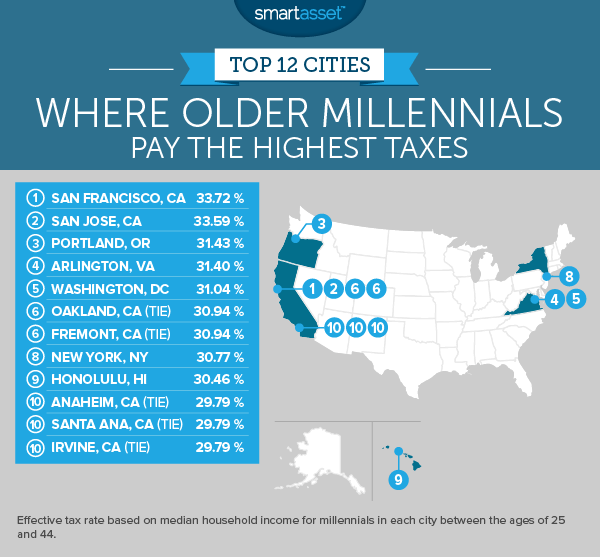

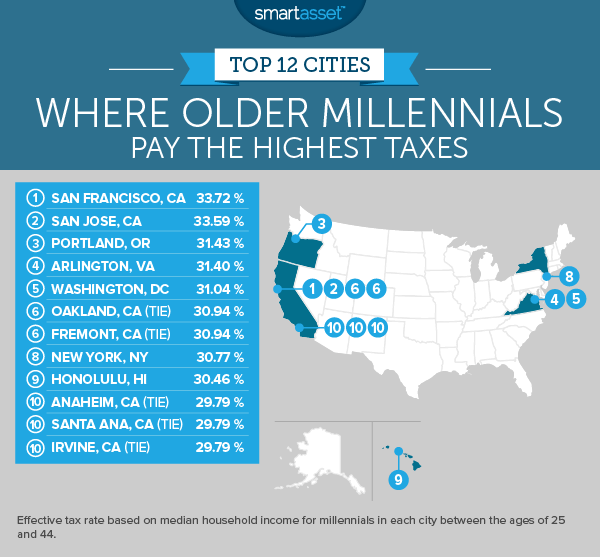

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Where Residents Are Most Likely To Pay State And Local Taxes Smartasset

84 000 A Year Now Qualifies As Low Income In High Cost Orange County Orange County Register

Irvine Approves New Middle Income Housing Projects Giving Up Millions In Tax Revenue

Irvine California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Understanding California S Property Taxes

Irvine Forgoes Property Taxes To Convert 1 000 Plus Units To Middle Income Housing Orange County Register

2017 California Income Tax What You Need To Know The Motley Fool

Irvine California Ca Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

12 Ways To Beat Capital Gains Tax In The Age Of Trump

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Cost Of Living In Irvine Ca Taxes Housing More Upgraded Home

Irvine Ca Cost Of Living Is Irvine Affordable Data Tips Info